A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at. All withholding tax payments other than those of NR public entertainers must be made with the relevant forms as indicated in the table above together with a copy of the.

Chart Women Pay High Tax Rates For Period Supplies Statista

Then if you qualify for any of the tax exemptions and reliefs those amounts will be deducted from your.

. This income tax calculator makes standard assumptions to provide an estimate of the tax you have to pay for 2021. Contract payments to non-resident contractors are subject to a total withholding tax of 13 10 for tax payable by the non-resident contractor and 3 for tax payable by the contractors. To complete a tax return expats need to fill out a Yearly Remuneration Statement EA form which is issued by the end of February every year.

Sales tax in Malaysia is a single-stage tax imposed at the manufactures level. The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are taxed at a flat rate of around 30. Tax Payment Via Credit Card Taxpayers can make payments of income tax and real property gains tax using a credit card online at httpsbyrhasilhasilgovmycreditcard These services.

1 on first RM100000 RM1000 2 on. Your total income will then be calculated and. Assuming your property price on the SPA is RM700000 lets work out how much you would have to pay for the Property Stamp Duty.

The more you reduce your chargeable income through tax reliefs and such the lesser your final tax amount will be. In the case of locally manufactured taxable goods sales tax is levied and. The assessment shall be made between CP500 instalment and tax payable.

First verify your personal details. If you dont meet the taxable threshold after-tax deduction the system will show 0 in the payable amount. If taxable you are required to fill in M Form.

Facilities Under The Sales Tax Act 1972. A non-resident individual is taxed at a flat rate of 30 on total taxable income. You can claim deductions on expenses related to the transactions as well as other expenses based on the general deduction rules.

In this form they will need to. Foreigners with a non-resident status are subjected to a flat taxation rate of 28 this means that the tax percentage will remain the. Firstly the total of all your incomes in the whole tax year will be added.

As an example lets say your annual taxable income is. Our calculation assumes your salary is the same for 2020 and 2021. If the instalment amount CP500 is insufficient the amount difference must be made to IRBM not later than the.

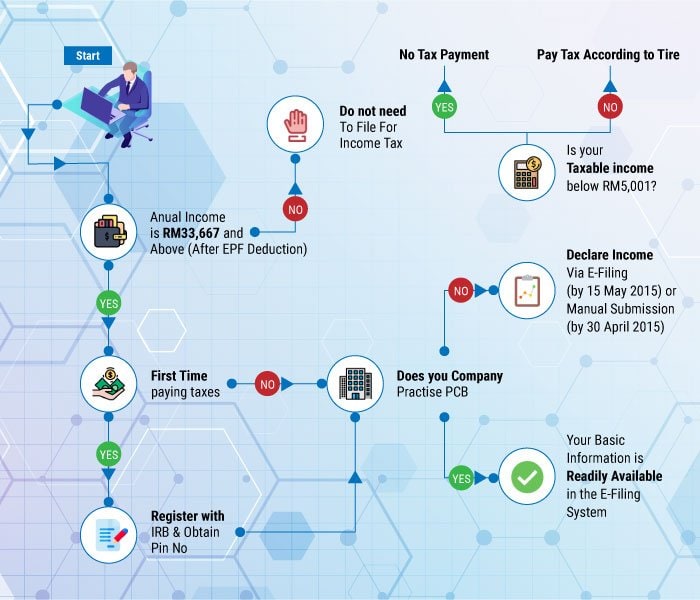

Because Malaysia employs a self-assessment tax system youd need to figure out your taxable income as well as responsible to submit or declare your income tax return to the. All withholding tax payments other than for non-resident public entertainers must be made with the relevant payment forms duly completed together with copy of invoices issued by the NR. Verify your tax information.

What To Expect If Your Buyandship Shipment Gets Taxed By Kastam Buyandship Malaysia

The Tax System In Malaysia Guide Expat Com

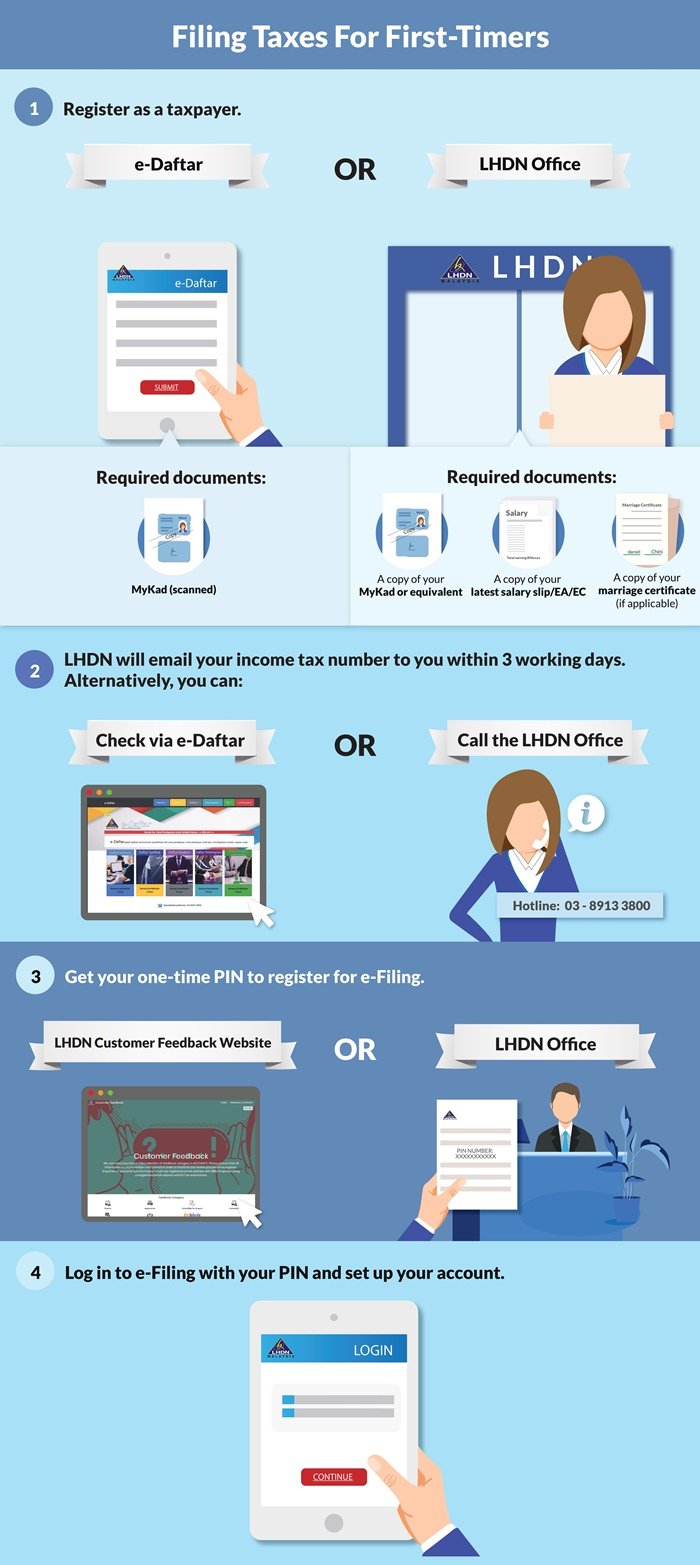

How To File Your Taxes For The First Time

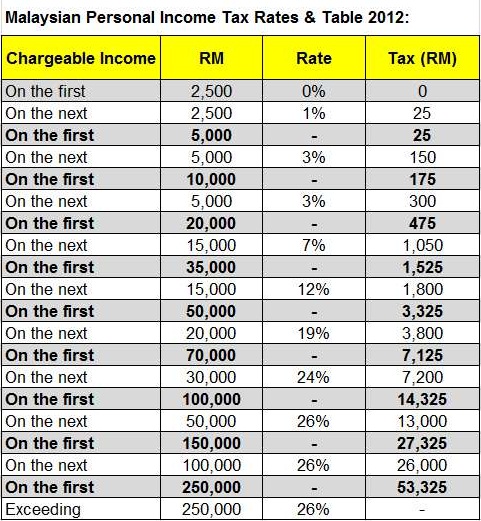

Malaysia Personal Income Tax Rates Table 2012 Tax Updates Budget Business News

Malaysian Tax Issues For Expats Activpayroll

Simple Tax Guide For Americans In Malaysia

Filing Income Taxes In Malaysia Mystery Solved By Other Expats Medium

Non Resident Personal Income Tax In Delaware 2022 Guide

Malaysian Tax Issues For Expatriates And Non Residents Toughnickel

Income Tax Filing Malaysia E Filing And Corporate Tax Return

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

How Do Foreigners File Taxes In Malaysia Quora

Tax In Malaysia Malaysia Tax Guide Hsbc Expat

Influencers Have You Paid Your Taxes

Countries With Zero Foreign Income Tax Nomad Capitalist

Tax Guide For Expats In Malaysia Expatgo

Digital Taxes Around The World Quaderno

Personal Income Tax E Filing For First Timers In Malaysia Mypf My